Pvm Accounting Things To Know Before You Buy

Table of ContentsPvm Accounting Things To Know Before You BuyExcitement About Pvm AccountingSome Known Questions About Pvm Accounting.Pvm Accounting Can Be Fun For EveryoneHow Pvm Accounting can Save You Time, Stress, and Money.The Basic Principles Of Pvm Accounting

Guarantee that the accounting process abides with the law. Apply required building and construction accounting requirements and treatments to the recording and coverage of construction task.Understand and keep common price codes in the accounting system. Interact with various funding firms (i.e. Title Company, Escrow Business) pertaining to the pay application process and requirements needed for repayment. Take care of lien waiver disbursement and collection - https://yoomark.com/content/pvm-accounting-full-service-construction-accounting-firm-if-you-spend-too-much-time. Display and fix financial institution problems consisting of charge anomalies and inspect differences. Help with implementing and keeping internal monetary controls and treatments.

The above statements are meant to explain the general nature and degree of work being done by people appointed to this category. They are not to be understood as an exhaustive checklist of responsibilities, duties, and skills called for. Personnel may be required to execute obligations outside of their normal responsibilities from time to time, as needed.

Pvm Accounting for Dummies

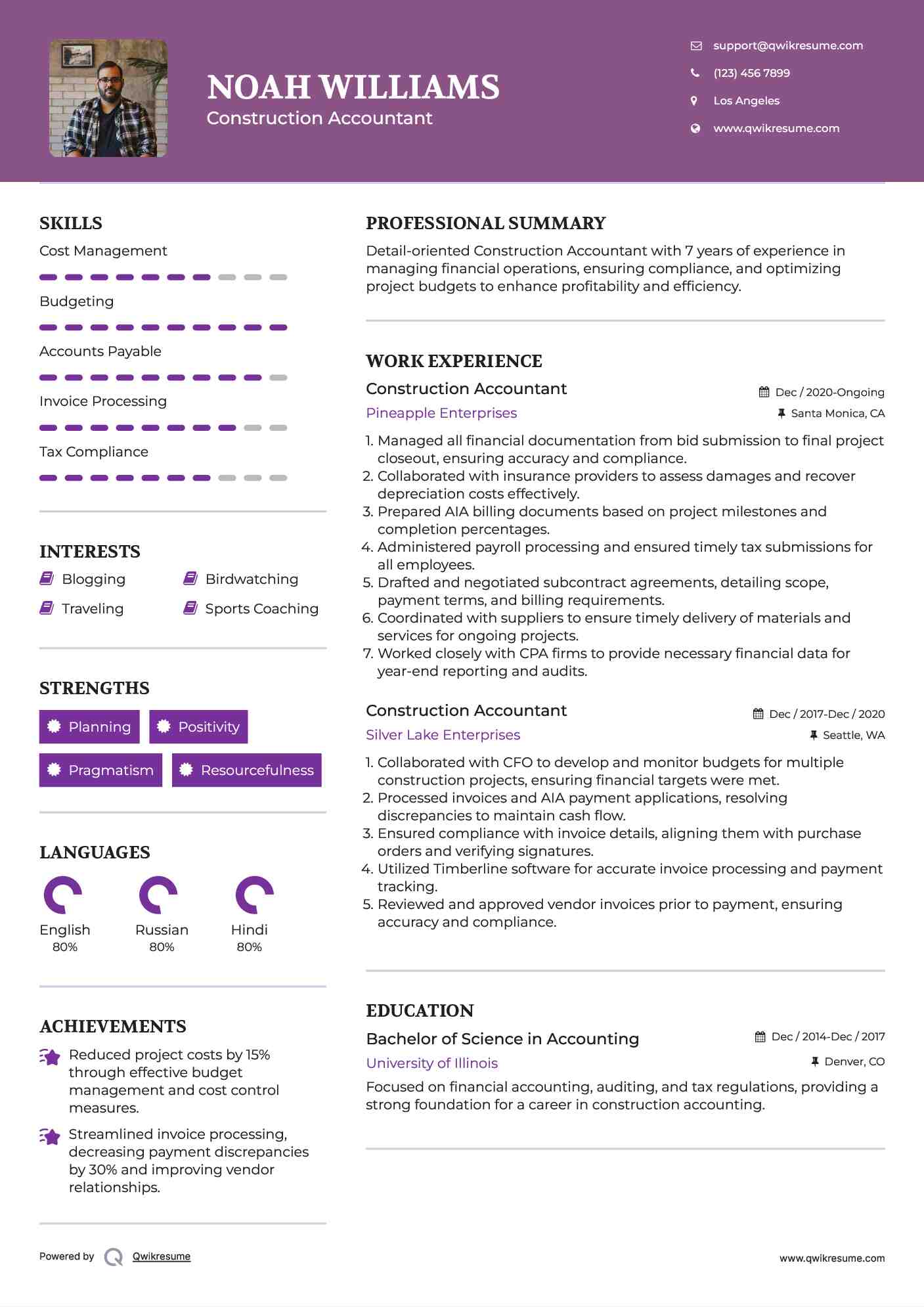

You will aid sustain the Accel team to guarantee delivery of effective promptly, on spending plan, tasks. Accel is looking for a Building and construction Accountant for the Chicago Workplace. The Construction Accountant performs a variety of bookkeeping, insurance coverage conformity, and project management. Works both individually and within particular divisions to maintain monetary documents and make sure that all documents are kept present.

Principal obligations include, however are not restricted to, managing all accounting features of the company in a timely and exact fashion and offering records and timetables to the company's CPA Company in the prep work of all monetary declarations. Ensures that all accountancy treatments and features are managed precisely. Liable for all financial documents, payroll, financial and daily operation of the accountancy feature.

Prepares bi-weekly trial equilibrium records. Functions with Project Managers to prepare and upload all regular monthly billings. Processes and concerns all accounts payable and subcontractor repayments. Generates regular monthly recaps for Employees Compensation and General Responsibility insurance policy premiums. Produces monthly Task Cost to Date reports and functioning with PMs to reconcile with Task Supervisors' budget plans for each job.

The Basic Principles Of Pvm Accounting

Proficiency in Sage 300 Building and Actual Estate (previously Sage Timberline Workplace) and Procore building administration software program a plus. https://pvmaccount1ng.start.page. Have to additionally excel in other computer system software systems for the prep work of records, spreadsheets and various go to my site other bookkeeping evaluation that may be needed by management. construction taxes. Must have strong business skills and capacity to prioritize

They are the monetary custodians that ensure that building and construction projects stay on spending plan, abide by tax obligation laws, and maintain monetary openness. Construction accountants are not simply number crunchers; they are critical partners in the building and construction process. Their main duty is to manage the monetary facets of construction jobs, guaranteeing that sources are assigned successfully and financial risks are reduced.

The Buzz on Pvm Accounting

They function closely with project supervisors to develop and monitor budgets, track expenditures, and projection monetary requirements. By preserving a tight grip on task funds, accounting professionals assist avoid overspending and financial setbacks. Budgeting is a keystone of successful construction jobs, and construction accountants are instrumental in this respect. They develop in-depth budget plans that encompass all task expenditures, from materials and labor to permits and insurance.

Construction accounting professionals are well-versed in these guidelines and ensure that the job abides with all tax obligation needs. To excel in the function of a building and construction accountant, individuals require a strong educational foundation in accountancy and money.

Additionally, qualifications such as Certified Public Accountant (CERTIFIED PUBLIC ACCOUNTANT) or Qualified Construction Industry Financial Expert (CCIFP) are very regarded in the industry. Working as an accounting professional in the building and construction industry includes a special collection of challenges. Building tasks frequently include limited deadlines, altering laws, and unexpected costs. Accountants have to adapt quickly to these difficulties to keep the job's monetary health and wellness undamaged.

Excitement About Pvm Accounting

Ans: Building and construction accountants produce and keep track of spending plans, recognizing cost-saving chances and guaranteeing that the project remains within budget plan. Ans: Yes, construction accounting professionals handle tax conformity for construction tasks.

Intro to Building And Construction Accounting By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building and construction business need to make tough choices amongst numerous economic options, like bidding process on one job over an additional, choosing funding for materials or tools, or setting a job's profit margin. In addition to that, construction is a notoriously volatile sector with a high failing price, sluggish time to settlement, and inconsistent capital.

Production includes repeated processes with conveniently identifiable costs. Production calls for different procedures, materials, and devices with varying expenses. Each task takes location in a brand-new location with differing website conditions and one-of-a-kind challenges.

Pvm Accounting - The Facts

Frequent use of different specialty professionals and providers impacts efficiency and cash flow. Payment arrives in complete or with normal settlements for the complete agreement amount. Some portion of payment might be held back till job completion also when the specialist's job is completed.

Regular production and temporary agreements result in manageable cash circulation cycles. Uneven. Retainage, sluggish payments, and high upfront prices bring about long, uneven capital cycles - Clean-up accounting. While typical makers have the advantage of regulated atmospheres and enhanced manufacturing procedures, building companies need to regularly adapt per brand-new project. Also somewhat repeatable projects call for alterations because of site problems and various other aspects.

Comments on “What Does Pvm Accounting Do?”